Financial Analysis Training for Australian Industries

We've built something different here. Not another generic finance course, but a practical exploration of how Australian businesses actually work with their numbers.

Starting September 2025, we're running sessions that dig into real industry scenarios. Mining operations tracking equipment depreciation. Agricultural businesses dealing with seasonal cash flow. Retail chains managing inventory across states.

It's the kind of analysis work you'd encounter in actual companies, not textbook examples from somewhere else.

How We Actually Run This

Six components that build on each other. Each one connects to what you've already learned.

Industry Context Sessions

We start with how different sectors actually report their finances. Mining companies don't present data the same way tech startups do.

You'll spend time looking at real annual reports from Australian companies, picking apart what matters and what's just noise.

Data Collection Methods

Where does financial information actually come from? We cover ASX filings, company registers, industry databases.

But also the messy stuff - incomplete records, conflicting sources, gaps you need to acknowledge in your analysis.

Analysis Frameworks

Standard ratio analysis, yes. But also judgment calls. When do you adjust for one-time events? How do you account for industry-specific factors?

We work through examples where the "right" answer depends on what question you're trying to answer.

Comparative Studies

Benchmarking gets complicated fast. Comparing a Perth mining company to a Sydney services firm doesn't make sense.

You'll learn to build meaningful peer groups and recognize when comparisons break down.

Report Construction

Writing up findings for different audiences. A board presentation looks nothing like an investor memo or a regulatory filing.

We look at examples of both clear and confusing financial writing, then you try your hand at it.

Current Developments

Regulations change. New reporting standards appear. Industry practices shift.

The final sessions cover what's changing in 2025 and how it affects analysis approaches going forward.

The Actual Schedule

We're planning for autumn 2025, probably kicking off in September. Sessions run Tuesday and Thursday evenings, 6:30 to 9:00 PM, at our Bankstown location.

Total commitment is about 14 weeks. Some sessions will be hands-on workshops. Others are more discussion-based, working through case studies as a group.

Foundations Block (Weeks 1-3)

Getting familiar with Australian corporate structures, reporting requirements, and where to find reliable financial information. We'll map out major industry sectors and their typical financial characteristics.

Industry Deep-Dives (Weeks 4-7)

Four weeks focusing on different sectors each session - resources, agriculture, retail, and services. What makes financial analysis different for each? What patterns show up consistently?

Analysis Techniques (Weeks 8-10)

Working with actual company data to practice ratio analysis, trend identification, and peer comparison. Includes one session dedicated to spotting red flags and questionable accounting practices.

Application Projects (Weeks 11-14)

Small group work on comprehensive analysis projects. You'll pick an ASX-listed company, conduct analysis, and present findings. Final session covers peer review and feedback.

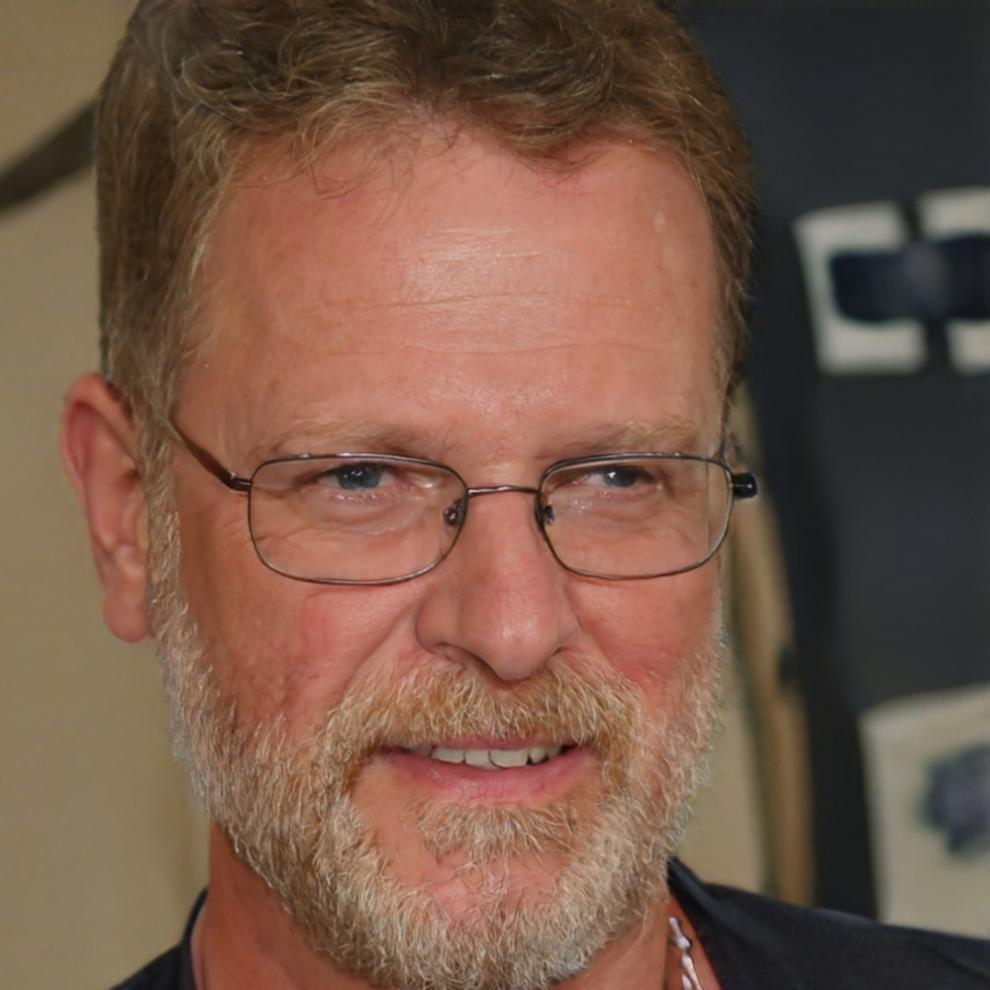

Who's Running the Sessions

Three people with different backgrounds in Australian financial work. They've all dealt with the practical side of industry analysis, not just the theory.

Callum Thornbury

Spent eight years with mining companies in WA before moving into consulting. He knows the complexity of resource accounting and commodity price impacts.

Stellan Viklund

Worked with retail chains across Australia analyzing store performance and supply chain finances. Good at making sense of complicated operational data.

Declan Ashworth

Background in agribusiness finance, understanding seasonal patterns and rural sector challenges. Previously worked with cooperative structures and family-owned operations.

Want More Information?

We're finalizing the September 2025 schedule now. If you're interested in joining or just want to know more about how this works, reach out and we'll send you the full program details.

Get in Touch